Don't forget to use protection

Property Insurance

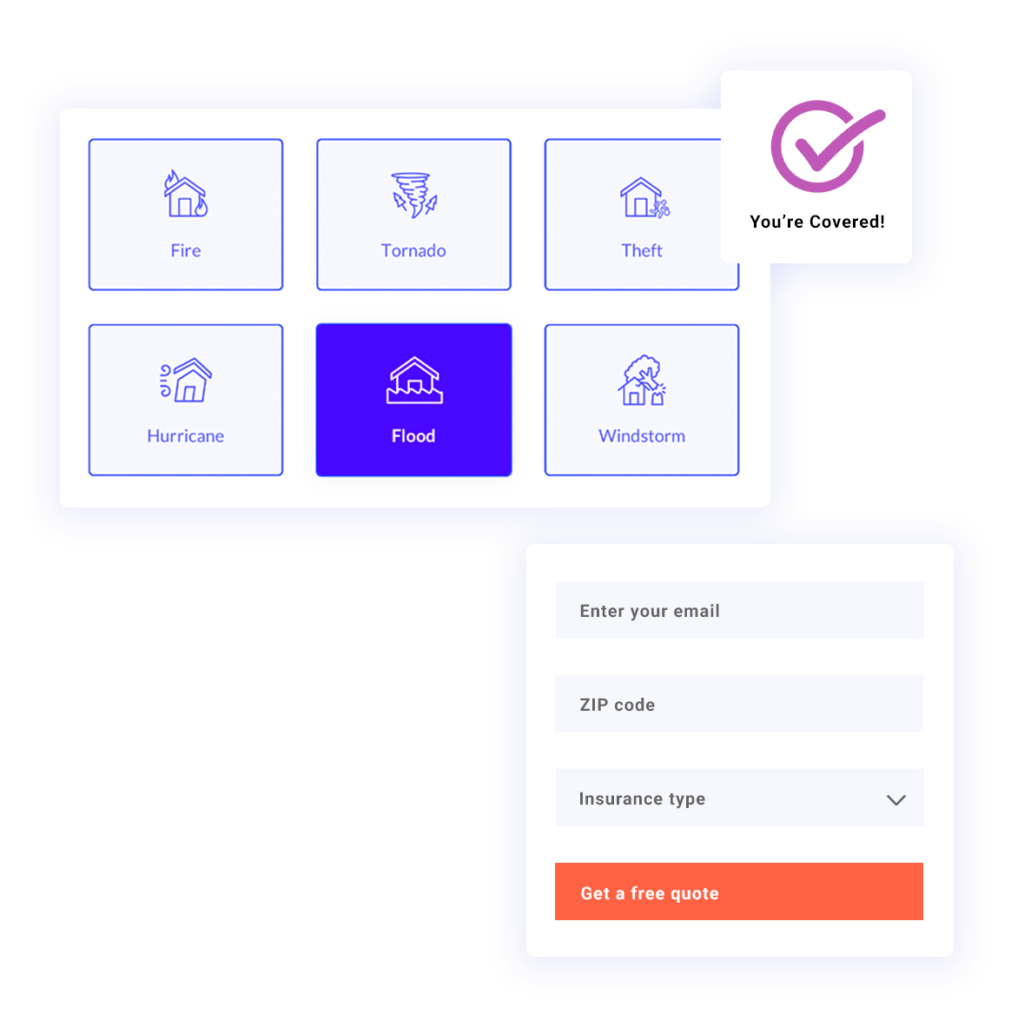

Property insurance is a vital coverage that safeguards property owners and renters. Homeowners, renters, and flood insurance policies offer essential protection against risks such as fire, flooding, theft, and weather-related damages, ensuring comprehensive security for both property owners and tenants.

Types of Property Insurance

See which insurance policy is right for you

Home

Covers a private residence.

Condo

Covers belongings and liabilities.

Renter

Covers belongings and liabilities.

Landlord

Covers damages to a rental property.

Know How You Are Protected

Learn about your coverage as a policy holder

Dwelling

Damages to the structure of your home

Property insurance is vital to protect your home's structure from risks like fire, storms, flooding, and accidental damage. It provides financial security, ensuring that you can repair or rebuild your property without bearing the full financial burden.

Homeowners coverage goes beyond protecting the dwelling itself; it extends to safeguarding personal belongings within the home. This includes furniture, decorations, clothing, electronics, and more. In the event of theft, damage, or destruction, homeowners coverage ensures financial compensation for the loss or damage to your personal possessions, providing valuable peace of mind.

Personal Belongings

Damage or theft to your personal property

Personal Liability

Someone else's damage or injuries

Accidents occurring on your property can leave you liable for medical expenses and other bills. However, property insurance with personal liability coverage alleviates this concern. It provides financial protection and coverage in case someone is injured on your property, relieving you of the burden of potential legal and medical costs.

Replacement Cost

Property insurance covering replacement costs ensures that in the event of a covered loss, you receive the funds necessary to replace or rebuild damaged property without factoring in depreciation.

Actual Cash Value

Actual cash value coverage, in property insurance, reimburses you for the current market value of damaged or lost property, considering depreciation over time.

Extended Replacement Costs

Property insurance that goes beyond the policy's stated coverage limit, providing additional funds to rebuild or repair your property even if costs exceed the initial estimate

Learn More

Browse through our articles to determine what options are best for you.

A Comprehensive Guide to the Final Walkthrough Prior to Settlement

Purchasing a home is a monumental decision, both emotionally and...

Read MoreHow to Pick the Right Mortgage Lender

The process of buying a home can be overwhelming, especially...

Read MoreA Comprehensive Guide to Fees Charged by Title and Escrow Companies for Buyers

When purchasing a property, there are various fees and costs...

Read More