purchase or refinance a home

Home Mortgages

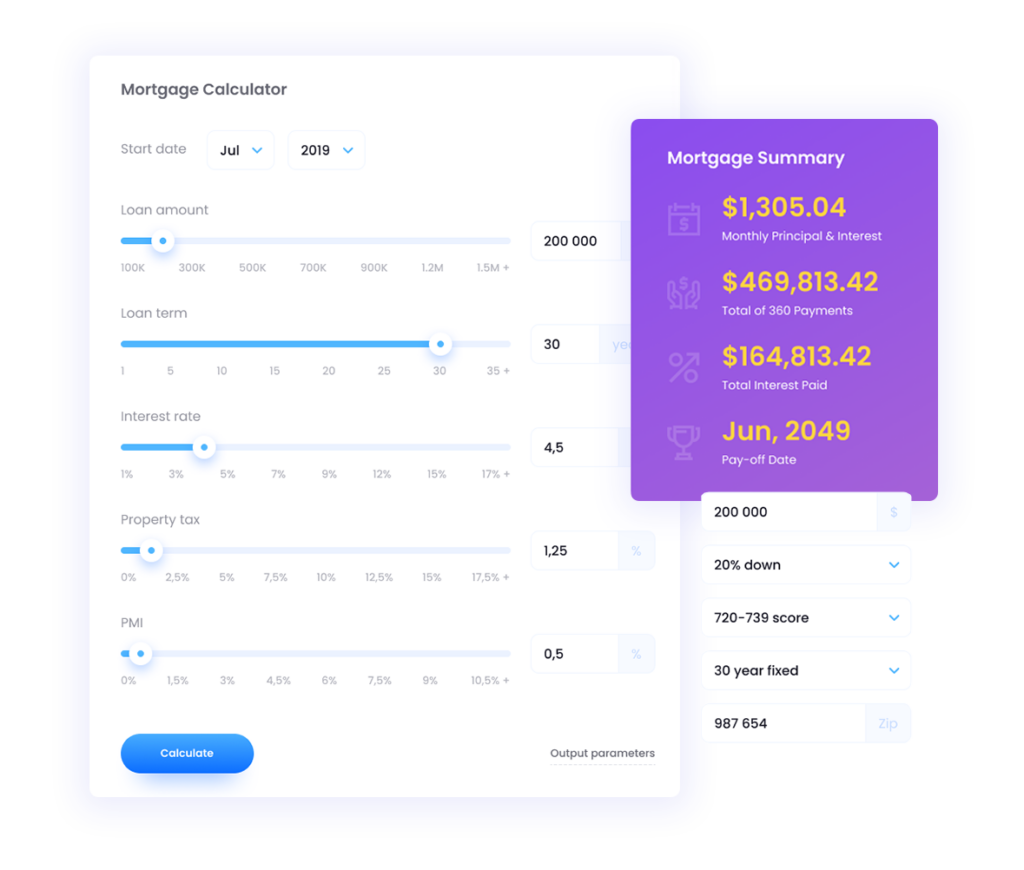

Your guide to all things lending – learn about what mortgages are, what options may be best for you, loan types, mortgage basics, refinancing, calculating mortgages, and managing.

Types of Home Loans

There are lending options available today for every type of homebuyer. From traditional conventional loans to guaranteed and insured products to out-of-the box alternatives for those who don't quite fit the typical mold - there's something for just about everyone

FHA

Backed and insured by the US government and great for people without stellar credit

Conventional

The traditional lending option. Available from 5% down, these loans are the most common

VA

Available for current and former members of the armed forces offering special terms

Construction

Borrow based on what the home will be worth upon completion.

Refinancing

Mortgage refinance involves obtaining a new mortgage to repay the existing one – explore various mortgage options available to home buyers.

Why should you refinance?

Refinancing can allow you to change the terms of your mortgage to secure a lower monthly payment, switch your loan terms, consolidate debt or even take some cash from your home’s equity to put toward bills or renovations.

You’ll want to look at your current financial situation and assess your long- and short-term financial goals and how much it’ll cost to refinance your mortgage. Timing is another huge consideration – some time frames are better than others when it comes to refinancing a mortgage.

Decide if Refinancing is for you

When should you refinance?

Waiting for interest rates to drop isn’t the only way you can qualify for a lower rate. You may also qualify if your credit score is now higher than it was when you applied for a loan. Why do mortgage lenders care about your credit score? Your credit score is a numerical representation of how well you manage debt.

Learn More

Want more information on home mortgages? Browse through our articles to determine what options are best for you.

How to Pick the Right Mortgage Lender

The process of buying a home can be overwhelming, especially...

Read MoreOur Lending Partners

We have partnered with mortgage companies to offer you the best rates and services. See which is best for your needs!